The Business Alignment Model: How to Make it Work for Your Company In 2023

In the early stages of a company, a common pitfall is a vague or ambiguous mission. A plethora of ideas, initiatives, and projects can pull

Manual accounting processes are notoriously time-consuming. By relying on spreadsheets to handle core finance operations like accounts payable, payroll and tax compliance, tasks that could be completed in seconds or minutes can take several hours or even days. What’s more, every step in the manual process is prone to human error, which can lead to additional costs, delays and frustration.

Enter accounting process automation (APA). By automating essential accounting operations with software, businesses can significantly speed up their processes while reducing the risk of human error considerably. This article explains the ins and outs of APA, including its benefits, which tasks to automate first and how cloud-based solutions bring new levels of speed, accuracy and security to accounting operations.

Accounting process automation involves the use of software solutions to automate finance and accounting tasks. Businesses have increasingly adopted APA to replace traditional accounting processes that rely on spreadsheets and manual handoffs between human stakeholders, both of which are less efficient and accurate.

Key Takeaways

Accounting process automation has many use cases. It can be used to enhance processes ranging from monthly reporting and the financial close to expenses and supplier invoicing and payment. It works by replacing manual record-keeping and information-sharing in spreadsheets with an automated approach that requires much less human intervention — and in many cases none at all.

Consider the case of accounts payable, a core finance operation that dictates how and when businesses pay their vendor bills. As a company grows, it has more payments to manage, which in turn makes its accounts payable processes more complex. Instead of reaching the point where that complexity leads to slow or missed payments and strained vendor relationships, the business can automate with APA, making the process more efficient and scalable.

It’s also worth distinguishing between accounting process automation and another popular automation technology, robotic process automation (RPA). RPA involves the use of software bots to complete simple and repetitive business processes, like invoice processing. APA goes even further, transforming accounting processes from end to end by replacing distinct manual tasks with an integrated digital workflow.

Accounting process automation leads to the faster, smoother and more accurate completion of accounting tasks. This more efficient process, in turn, delivers a range of benefits to a business and its customers, all of which stand to improve a company’s bottom line. Here are some of the biggest advantages of APA.

Time-savings is one of the primary drivers for process automation. Accounting tasks like bank reconciliation and quarterly reporting have traditionally required finance professionals to check and copy large volumes of data across multiple systems, which is a long and error-prone way of working. With APA, accounting data is automatically verified and moved between systems, saving finance teams from spending too many hours on tedious tasks.

Automated accounting processes are faster and require less human intervention. That makes them more cost-efficient in virtually every way. Take the case of accounts receivable. According to the American Productivity and Quality Center (APQC), the cost of invoicing a customer drops to as low as $2 for high-performing businesses, compared with $9 per invoice for the worst performers.

Manual data entry often leads to mistakes, which increase in frequency as the business and its accounting needs grow. This is another reason why automation can be an invaluable tool. With APA, finance teams can record, shift and update thousands of data points at once with minimal risk of that data being lost or compromised.

APA automates data entry and record-keeping on a centralized software platform. Instead of digging through spreadsheets or actual piles of paper to find a crucial document, accounting professionals simply need to enter the relevant search terms in their APA solution to find the files they’re looking for within seconds.

Similarly, documents like purchase orders and supplier contracts are automatically uploaded and made accessible to relevant stakeholders, eliminating bottlenecks from the approval process.

Mishandled invoices and delayed payments can strain relationships between businesses and their customers and suppliers. APA speeds the entire procure-to-pay cycle to all parties’ satisfaction.

APA software automatically prepopulates tax returns, creates financial statements and updates tax documents in line with regional regulatory requirements and rates. Not only does the software streamline processes, but it also ensures they are more accurate and compliant. Meanwhile, improved data visibility and integrity improve governance while easing the pressure on accounting teams that monitor compliance.

As with any new technology, accounting process automation can present challenges, especially if it’s not implemented correctly. Here are three worth considering:

Working with new technology naturally requires accounting teams to learn how to correctly adopt APA software. Upskilling may require patience as every employee will have different levels of comfort with using technology and relying on computerized processes to handle accounting tasks they had previously completed manually.

A well-defined automated workflow can work wonders, but a poorly adapted workflow, or one that has not been sufficiently tested, can lead to chaos and accounting errors on a large scale. Testing, iterating and perfecting APA workflows is the key to avoiding issues.

Resistance to change is a universal human trait, and accounting teams are not immune. They must be encouraged, supported and given the resources they need to learn how automation will make their jobs easier, so they can embrace APA and integrate the use of automation in their daily work.

Every business starts from a different position and adopts APA at its own pace. Some companies will choose to automate many processes at once while others will proceed more systematically, automating one task at a time in order of priority. Here are seven accounting tasks that every company can start to automate today.

Automating AP simplifies payment processes across the board. It helps accounting teams better track invoice due dates and ensures the on-time payment of vendor bills. What’s more, APA minimizes the risk of fraudulent invoices slipping by, flagging any the system deems suspicious or otherwise problematic.

Automating AR helps companies manage their cash flow, improve invoice accuracy and reduce processing costs significantly. Opportunities to automate exist throughout the AR process, from scheduling invoices to be sent to the collection of past-due payments.

Manual payroll is a major time drain for companies with limited accounting resources, especially as they grow and the demands on their accounting teams increase. Automating payroll processes helps to ensure employees are paid on time and that an overworked team never misses filing any important payroll forms.

The month-end financial close process is an essential business task, but it also can be one of the most stressful for finance teams. Accountants are under growing pressure to complete their monthly closes more quickly, which inevitably leads to rushed processes and questions around the validity of end-of-month results. Automation of the monthly close alleviates many of these pressures around speed and data accuracy, helping accounting teams deliver faster results without sacrificing quality.

The procurement of goods and services from external suppliers has traditionally involved a great deal of paperwork, all of which must be reviewed and processed manually by multiple stakeholders. By automating procurement processes like purchase order management, companies can cut significant time and cost from their procurement process without sacrificing the integrity of their processes or affecting their supplier relationships.

Expense reports are a necessary evil. At many companies, employees still need to print their expense reports as spreadsheets, staple receipts to forms manually and submit the whole package to accounting for approval. Automated expense reports allow employees to digitally fill out and share their expenses with accounting, reducing the administrative burden and paper pileup for all parties.

A clear sales order process is the key to ensuring customer orders are completed and shipped on time at the right price. Automation software allows businesses to codify every step of their sales order processes, ensuring they consistently meet customer expectations.

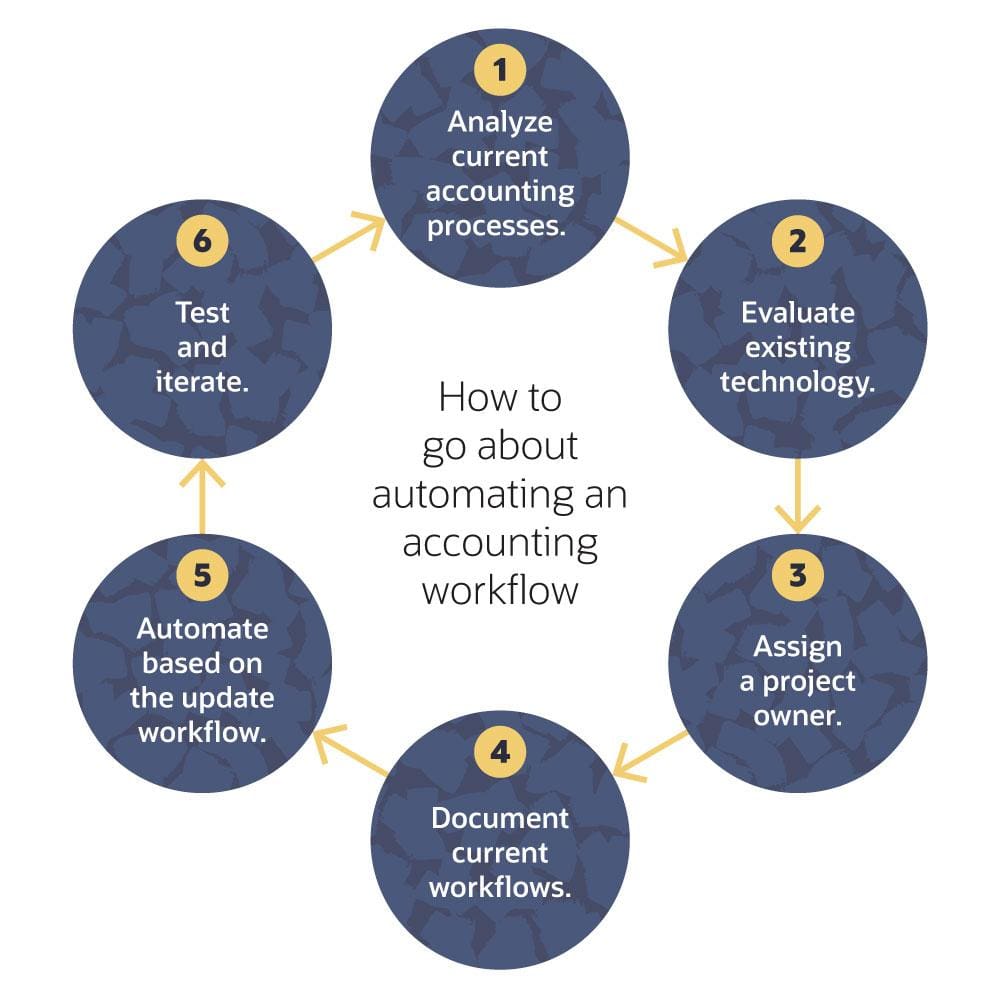

Automating accounting processes isn’t as simple as just buying APA software. It requires a methodical approach that starts with understanding the tasks that need to be automated, breaking them down step by step and adapting manual workflows to the way APA software works. It also involves testing to make sure the automated workflows perform as intended. Here are six steps businesses can take to automate their accounting processes.

Many, but not all, accounting processes can be automated. The best candidates for automation are tasks that require employees to do frequent, repetitive work, involve few interpersonal connections and take little to no creativity. The aim of automation is to boost speed and efficiency to help accounting teams, not replace them altogether.

APA is a software-based approach. The best automation approach for a business will depend on its existing accounting technologies and software applications, whether these systems already speak with each other or need to be integrated. In the latter case, cloud-based APA solutions are a popular option that unifies a company’s accounting and finance systems on a single platform where data is created, shared and processed in a common language.

Automated processes run on software alone, but it’s still important to have a human being oversee APA workflows to make sure everything runs smoothly and troubleshoot problems on the rare occasions they arise. For example, software runs off of rules set by users or the company admin, and those rules can cause inaccuracies in payroll, leading to late payments. A project owner can spot and address that issue before it affects employees, or at least mitigate the effects by fixing the problem quickly.

The goal of APA is to simplify existing workflows and make them more efficient, and the best way to do that is to look for opportunities to streamline processes. By breaking down existing workflows at a granular level, businesses will then see where they can be improved and how to best re-create tasks with an APA solution.

Every workflow in a business can be broken down into three parts: a trigger, an action and an outcome. When automating workflows, it’s important to spell out these three parts at a granular level to ensure they deliver the intended results every time.

Consider, for example, a simple workflow in the purchase order (PO) approval chain. A trigger might be the submission of a new PO from your procurement manager. That trigger would in turn set off an action, such as an automatic email to the relevant stakeholder in your business that the PO is ready for approval. The desired outcome is an approved PO.

To make sure that an automated workflow delivers the intended results consistently, businesses can test and iterate. One test run might be enough, but it’s common to test and iterate a few times to iron out wrinkles, especially when adapting manual workflows for automation software.

An accounting workflow describes the sequences of tasks involved in a specific accounting process, be it expense management, invoicing or employee-onboarding. The workflow helps finance managers organize, standardize and track these processes, while assigning clear responsibilities for their teams.

Consider the expense management workflow, which clearly outlines the path that an expense receipt takes from the instant an employee submits it to their expense management system to the moment they are reimbursed. Even this relatively simple accounting process workflow can be broken down into more than 10 steps:

The employee collects the receipts, credit card statements, bills and any other documents that prove a purchase was made.

Expense reports are the primary documents an employee uses to make their expense claims. They are generally submitted monthly.

Once submitted, an employee’s expense report is first validated by the person’s direct supervisor and company’s accounting team.

Once validated, the report is sent to other internal stakeholders — often managers and team leaders — to ensure the entries are legitimate and reimbursable.

Senior stakeholders review the expense report, approve it or send it back to accounting for revision. In the latter case, the process goes back to the beginning.

Once approved, the expense report goes to the AP coordinator to be posted and scheduled for on-time payment.

Receipts submitted with the expense report are verified and filed for tax and accounting purposes.

An accounting employee enters the correct ledger and/or tax code for each line item on the expense report.

With all the necessary information now included, expense items are added to the business’ accounting or ERP system, reviewed and approved, and then posted to the general ledger so that the employee can be paid.

The employee’s expense reimbursement is authorized and a payment date is set based on the company’s expense management schedule.

The employee receives their reimbursement payment.

Every accounting process has many moving parts, and they become more complex as a business grows. Accounting teams stand to save significant time and energy by simplifying recurring steps throughout their process workflow, be it expense management, client-on-boarding, billing and invoicing or countless others.

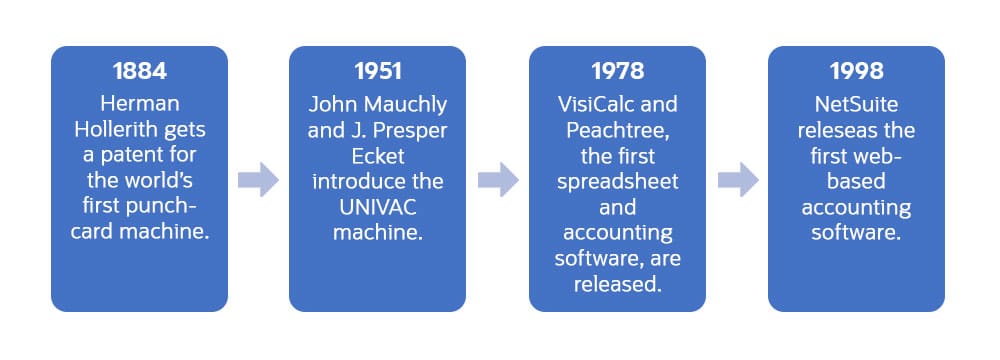

The history of accounting automation can be traced back to the 19th century, when inventor Herman Hollerith developed the world’s first punch-card machine to help streamline the United States Census. Hollerith would go on to become the founder of the company that led to the creation of IBM, where his punch-card invention was used for accounting.

The next big development in accounting machines came after World War II with the 1951 invention of the UNIVAC, the first commercial computer in the U.S. Developed by physicist John Mauchly and electrical engineer J. Presper Eckert, the Universal Automatic Computer saw data storage move from punch-cards to magnetic tape. This approach was first embraced by businesses in 1955, when General Electric bought a UNIVAC to handle its accounting operations.

Automation as we know it today first began to take form during the computer age. Since the late 1970s, programmers have been building increasingly powerful software to take on accounting tasks, from VisiCalc, the first-ever spreadsheet software, to Peachtree, the first accounting software for PCs. Adoption was swift, and within a few years millions of companies were running some form of accounting software.

Today, accounting automation has transcended physical offices and manual data management. Since NetSuite released the first web-based accounting software in 1998, finance teams have been able to access, manage and manipulate accounting data via an internet connection. Cloud-based accounting software continues to improve, speeding up accounting processes and fueling efficiencies across industries.

The adoption of automated accounting processes will only accelerate, but not at the expense of human thought and oversight. Automation is not intended to replace accountants; rather, its role is to take repetitive work off their plates so they can apply their valuable time and brainpower to strategic business imperatives.

Businesses that use cloud-based software will see these time-saving benefits compound with every new accounting task they automate. For instance, when their invoicing, spend management and general accounting platforms are integrated and automatically share data, finance teams will spend less time copying data points from one system to the other and will instead have a single, accurate view of all their accounting data in a single location.

Automation dramatically speeds up a range of accounting processes, reducing both overhead and the risk of human error. But cost and efficiency gains are only part of the story. Improved data management and visibility also help with increasingly important mandates, like regulatory compliance.

NetSuite’s Cloud Accounting Software delivers a complete accounting solution for companies ready to move from spreadsheets or entry-level software to a fully integrated and automated platform that centralizes their data and makes it accessible to stakeholders across the business. In turn, accounting teams spend less time on manual data entry and repetitive tasks, and instead use their more complete view of accounting data to make faster and better-informed decisions to support their businesses.

APA helps accounting teams unlock their full potential by increasing efficiency and optimizing the many essential tasks they manage, saving them time and improving the accuracy of results. For years, manual accounting processes were labor-intensive, costing businesses extra time and money. With APA, businesses of all sizes are increasingly overcoming that hurdle.

Robotic process automation (RPA) involves the use of software bots to replace manual and repetitive accounting tasks at scale. It is generally used to handle low-skill work, rather than replacing the complex thinking required to handle strategic accounting tasks, like planning and budgeting.

Artificial intelligence (AI) has many uses in accounting. Whether it’s understanding digital files through natural language processing (NLP), extracting data from photos with computer vision algorithms or automatically populating forms to speed up accounting workflows, new use cases for AI in accounting are regularly emerging.

When combined with artificial intelligence, RPA can scan, understand and digitize key data points from an invoice for further processing.

An automated accounting process is handled by software, replacing the need for staff members to manually complete repetitive tasks, such as data entry, number crunching and transaction tracking.

To automate an accounting task, businesses first need to break the task down into a step-by-step workflow. From there, they can build an automated workflow that will deliver the same results with little human intervention.

Accounting teams can automate many elements of their accounting, from invoice processing and payroll to the monthly financial close. That said, automation technology will never replace accounting staff entirely, as human brainpower and experience will always be required to troubleshoot, handle complex accounting tasks and align them with business strategy.

Numerous accounting tasks can be automated. Some of the most popular tasks that benefit from automation include accounts payable, accounts receivable, payroll, expense management and the monthly financial close, among others.

In the early stages of a company, a common pitfall is a vague or ambiguous mission. A plethora of ideas, initiatives, and projects can pull

Today’s business environment is fast paced, hypercompetitive and constantly changing. It’s no place for the rearview-mirror finance and accounting processes of old. Instead, companies are

Collaboration tools are the utensils of the workplace. SharePoint and Teams, for example, each bring unique features to the table. One provides a central location

“I don’t remember where that file is.” “They said that all of the project details are in last week’s conversation. But which conversation?!” “There are